Plan your wealth with the Kenya Investment Calculator. Calculate compound interest for Money Market Funds (MMF), Saccos, and Treasury Bonds.

Investment Calculator

ESTIMATED FUTURE VALUE

KES 0.00

*Results assume monthly compounding. Actual returns may vary based on market conditions and tax implications.

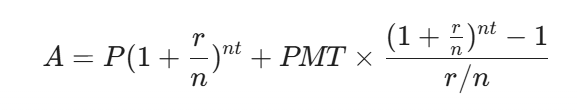

Investment Formula

The logic behind this tool relies on the Compound Interest Formula for Monthly Contributions. Unlike simple interest, compound interest calculates returns on both your initial principal and the accumulated interest from previous periods.

Where:

- A: Future value of the investment.

- P: Initial principal (starting balance).

- r: Annual interest rate (decimal).

- n: Number of times interest is compounded per year (12 for monthly).

- t: Number of years the money is invested.

- PMT: Monthly contribution amount.

How to Use the Investment Calculator

To get the most accurate projection for your Kenyan investments, follow these steps:

- Initial Investment: Enter the lump sum you currently have (e.g., your current MMF balance).

- Monthly Contribution: Input the amount you intend to “top up” every month via M-PESA or standing order.

- Annual Return: Use realistic 2026 market rates.

- MMFs: 11% – 15%

- Sacco Dividends: 10% – 13%

- Treasury Bonds: 14% – 18%

- Years to Grow: Set your time horizon (e.g., 5 years for a car, 15 years for retirement).

Frequently Asked Questions (FAQs)

1. What is the best investment for a beginner in Kenya?

For beginners, Money Market Funds (MMF) are highly recommended due to high liquidity (easy withdrawal), low risk, and professional management. They currently offer better returns than standard bank savings accounts.

2. Is compound interest better than simple interest?

Yes. Simple interest only calculates returns on the principal. Compound interest—which most Kenyan Saccos and MMFs use—reinvests your earnings, leading to exponential growth over time.

3. Are investment returns in Kenya taxed?

Yes. Most investment interest is subject to a 15% Withholding Tax in Kenya. However, Infrastructure Bonds (IFB) issued by the government are usually tax-free, making them very attractive for high-net-worth individuals.

4. How much should I invest monthly?

Financial experts recommend the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and investments. Use the calculator to see how even KES 2,000 a month grows over 10 years.

Explore our useful daily calculators