Use our loan repayment calculator to computer your monthly loan installments for bank, Sacco, or digital loans in Kenya. Estimate total interest and repayment periods using the reducing balance method.

Loan Repayment Calculator

KES 0.00

Monthly Repayment

*Calculated on a reducing balance basis. Standard bank processing fees are not included.

How to Calculate Loan Repayment Amount

The standard method used by Kenyan banks is the Reducing Balance Amortization. This means interest is calculated on the remaining principal balance each month, not the original amount borrowed.

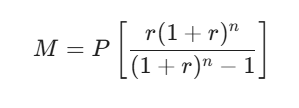

The Mathematical Formula

To calculate your Equated Monthly Installment (EMI), the formula is:

Where:

- M: Your Monthly Repayment.

- P: Principal amount (The amount you want to borrow).

- r: Monthly interest rate (Annual rate divided by 12).

- n: Number of monthly installments (The loan term).

Also see: Investment Calculator | KCB M-PESA Loan Calculator | KCB Loan Calculator

Factors Affecting Your Loan Repayment

- Interest Rates: In Kenya, rates are often pegged to the Central Bank Rate (CBR). If the CBR rises, your bank may adjust your interest rate upward.

- Loan Term: A longer period (e.g., 36 months vs. 12 months) lowers your monthly installment but significantly increases the Total Interest paid.

- Processing Fees: Most Kenyan lenders charge an upfront fee of 1.5% to 3% of the loan amount, plus excise duty.

FAQS

1. How much loan can I get on a Kshs. 25,000 salary?

In Kenya, lenders follow the One-Third (1/3) Rule. This means your total deductions (including the new loan) cannot exceed 2/3 of your basic salary.

- On a Kshs. 25,000 salary, your maximum monthly repayment capacity is roughly Kshs. 8,333.

- At an interest rate of 14% for 3 years, you could qualify for approximately Kshs. 240,000, depending on your existing debts and credit score.

2. How much is 5% interest on Kshs. 5,000?

- Simple Interest: 5,000 × 0.05 = Kshs. 250.

- Digital Loans: Many Kenyan mobile apps charge 5% as a one-time facility fee or a monthly flat rate. If it’s a monthly rate, you would pay back Kshs. 5,250 within 30 days.

3. Can a loan calculator help me save money?

Absolutely. By using a calculator, you can compare different lenders’ rates and see how much you save by:

- Shortening the term: Reducing a 3-year loan to 2 years can save you thousands in interest.

- Paying extra: Seeing how “top-ups” or early repayments reduce the principal faster.

- Comparing Rates: Spotting the difference between a 13% and 16% interest rate before signing the offer letter.

4. What is the difference between flat rate and reducing balance?

A flat rate calculates interest on the full principal for the entire duration, making it much more expensive. A reducing balance (used by most banks) only charges interest on the money you still owe, making it the cheaper option for the borrower.